Look at Taxes Like a Menu, Not Just a Bill

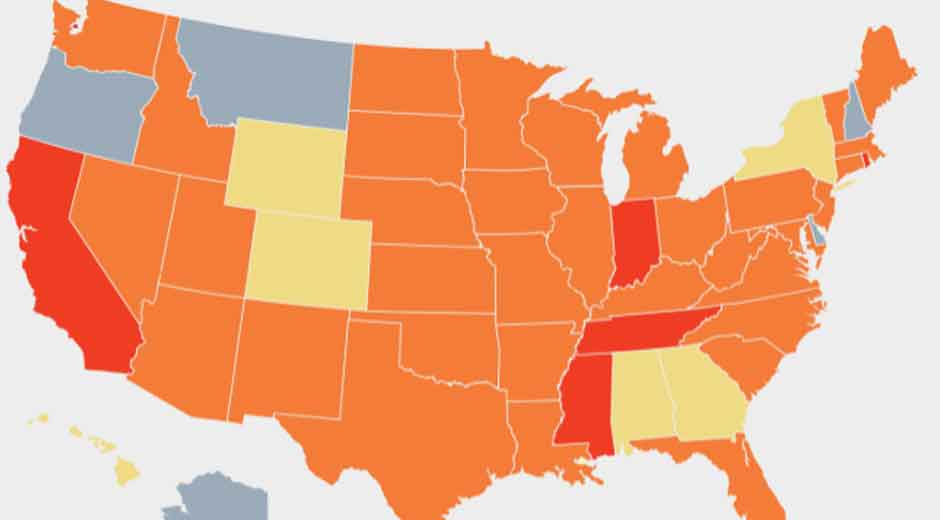

When people talk about taxes, it often feels like everyone is comparing a simple number. But taxes are more like a menu than a single bill. Some states charge you heavily for income but give you a break on property taxes. Others skip income taxes but get you with higher sales taxes. It all depends on your situation and what you value most. If you are already dealing with financial challenges and looking for credit card debt relief, the idea of living in a state with a lower overall tax burden can sound pretty appealing. Let’s take a closer look at seven states that often stand out for their low tax burdens, especially when it comes to income tax.

Wyoming: The All Around Tax Friendly State

Wyoming often tops the list for having one of the lowest overall tax burdens in the country. The state has no personal income tax, no corporate income tax, and relatively low property taxes. Sales tax is also lower than the national average. This makes Wyoming especially attractive for retirees, business owners, and people trying to rebuild their finances after dealing with debt. However, keep in mind that other costs like housing and healthcare may still be factors depending on where you settle within the state.

Alaska: No Income Tax and Permanent Fund Dividends

Alaska takes tax friendliness a step further by not only skipping state income tax but also offering residents an annual payout through the Alaska Permanent Fund. This dividend comes from the state’s oil revenue and can amount to a few thousand dollars each year. Sales tax is low or nonexistent in many areas, though some localities do have their own small sales taxes. For people who are serious about keeping more of their paycheck, Alaska can feel like a financial win. Of course, the cost of living can be higher due to its remote location and unique climate, so that is something to weigh carefully.

Florida: Sunshine and No State Income Tax

Florida is well known for its lack of a state income tax, making it a popular destination for retirees and people relocating from higher tax states. While Florida does have sales tax and some higher property taxes depending on the area, the absence of income tax allows residents to keep more of their earnings. This can be especially helpful for anyone trying to recover from financial hardship or credit card debt relief, since more take home pay means more flexibility to build savings or pay off debt faster.

Texas: Big State, No Income Tax

Texas joins the no income tax club as well, which is one of the reasons so many people have been flocking to the state in recent years. However, Texas makes up for the lost income tax revenue with higher property taxes and a fairly high sales tax. This means that while you may save on one part of the tax menu, you could end up paying more on another. Still, for many families and individuals looking to maximize their take home pay, Texas remains a very attractive option.

Nevada: No Income Tax and a Focus on Tourism

Nevada gets most of its revenue from tourism, casinos, and entertainment, which allows it to avoid charging residents a state income tax. Sales taxes and some business taxes do apply, but overall, Nevada remains one of the most tax friendly states for individuals. This can be particularly helpful for entrepreneurs or remote workers who want to enjoy the flexibility of keeping more of their earnings while living in a state with plenty of recreation options.

South Dakota: Business Friendly and Low Personal Taxes

South Dakota is another state that avoids personal income taxes entirely. In addition, the state is known for its very low property taxes and no inheritance tax, making it attractive for estate planning and long term financial stability. South Dakota has also built a reputation for being business friendly, which is great for entrepreneurs. For individuals recovering from debt and working toward financial independence, South Dakota’s low tax burden can make saving and rebuilding much more manageable.

Tennessee: No More Income Tax on Wages

Tennessee used to have a limited income tax on investment income, but as of 2021, that tax has been fully phased out. Now, Tennessee residents pay no income tax on wages or investments. The state does have higher sales taxes and some of the highest combined state and local sales tax rates in the country, so purchases can be more expensive. Still, the absence of income tax provides immediate relief for wage earners, especially those working to climb out of credit card debt or build a stronger financial foundation.

Picking the Right State for You

Choosing a low tax state is not just about looking for the place with zero income tax. You need to consider your full financial picture: property taxes, sales taxes, cost of living, and your personal goals. If your main focus is increasing your take home pay to deal with debt or boost savings, states like Florida, Texas, or Tennessee may serve you well. If you value low property taxes and long term stability, Wyoming or South Dakota might be more appealing. And if you are drawn to adventure and don’t mind higher costs in some areas, Alaska or Nevada could fit the bill.

A Tool, Not a Total Solution

Moving to a low tax state can definitely help ease your financial burden, but it is not a magic fix. Budgeting, smart spending, and responsible debt management are still key to long term financial health. Tools like credit card debt relief and debt consolidation may be necessary first steps before relocating. But once you have your financial house in order, living in a state with a lower tax burden can give you more breathing room to enjoy life and build wealth.