Are you looking for an investment option that offers attractive growth? Momentum stocks can be suitable options for you. Known for their stable past record and performance, these stocks are quite popular. They focus on an upward trend, which ensures their consistent returns.

But many investors feel that the best time to invest in these stocks is already over. So, are momentum stocks actually worth investing in or are these stocks already overbought in the market? Well, read this to get an answer to the same.

Why Do Momentum Stocks Seem Overbought?

Buying momentum stocks often comes with the fear of buying stocks that seem overbought. These stocks have performed quite well in the past and have offered higher returns. But will they offer similar returns now? This is a common question and fear. Here are certain facts that can help you understand why this might not be true.

1. Sharp Price Rise

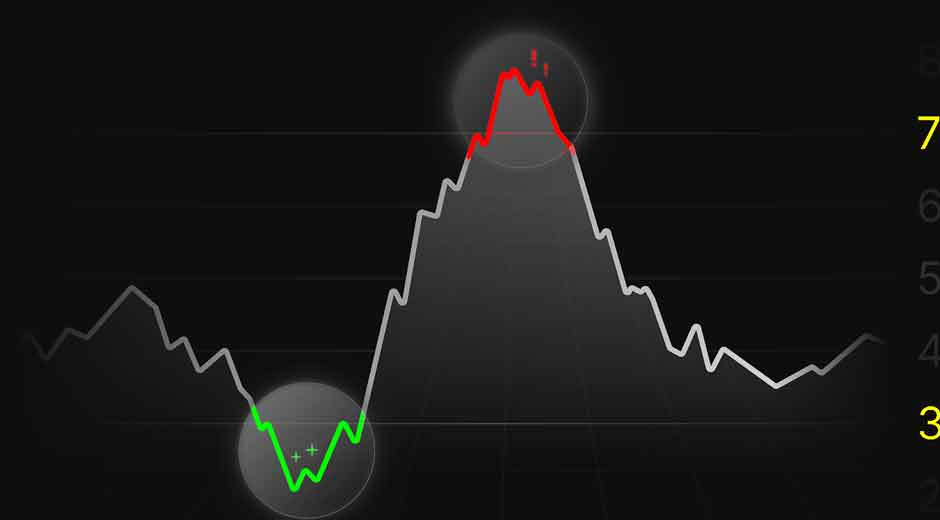

Momentum stocks often see a quick and strong rise in their prices, which makes them look expensive compared to their past trading levels. This sudden jump creates fear among investors that they might be buying at the top, risking a quick price reversal.

2. High RSI Levels

The RSI measures the speed and magnitude of recent price changes on a scale from 0 to 100. When a stock’s RSI rises above 70, it is generally considered overbought. This suggests that the stock may be due for a pullback or at least faces increased risk of near-term selling pressure. This is commonly seen in momentum stocks.

3. Excessive Buying by Traders

When traders see a strong trend, they rush to buy, hoping to gain from the rise. This large-scale buying pushes the stock price even higher, making it look overbought and possibly unsustainable if demand slows down later.

4. Market Hype and News

Momentum stocks often get heavy media coverage or analyst upgrades. This creates hype, leading to quick buying by investors who fear missing out, pushing prices to levels that may not match the company’s true growth potential.

5. Stretched Valuations

Strong momentum can push valuations far above the company’s fundamentals. If this happens, there is a chance that the prices that are reflected do not consider the actual fundamentals. This can increase the overall risk. Also, any sudden change in the market conditions can impact the share price adversely.

Should You Invest in Momentum Stocks?

Investing in momentum stocks can be a good strategy if done with care. These stocks tend to continue their upward trend because of strong demand and positive market sentiment. However, they come with risks as prices can reverse quickly if the trend breaks.

If you plan to invest in momentum stocks, you should have a clear entry and exit plan. Using stop-loss orders can help limit your losses if the stock price falls. Also, avoid putting all your money in momentum stocks. Keep your portfolio diversified to balance risk.

In short, momentum investing can work well if you stay disciplined and avoid chasing stocks blindly.

Tips to Select the Right Momentum Stocks

Now that you know why momentum stocks often seem overbought, you might wonder how to choose the right ones without falling into risky trades. Here are some simple tips to help you pick strong momentum stocks for your portfolio.

- Choose stocks with strong price gains in the last 3 to 12 months.

- Pick stocks with RSI between 50 and 70 to avoid extreme overbought levels.

- Check for rising trading volumes to confirm buying strength.

- Select stocks with recent positive news or earnings upgrades.

- Avoid stocks with poor earnings or high debt levels.

- Always set a stop-loss to protect against sudden price reversals.

Conclusion

Investing in momentum stocks gives an option to grow your wealth if done with discipline. But while you plan to invest in these stocks, you must ensure to follow the basic strategies, like stop-loss, to limit the risks.

At the same time, you can also use the latest tools like a free stock screener, and adopt proper technical analysis steps to find top momentum stocks. This will help you build a strong portfolio over time.