Algorithmic (algo) trading is a method of executing trades using pre-programmed instructions based on variables such as time, price, and volume. It works by analysing market data in real-time to find trading opportunities and execute orders at optimal times and prices.

Nowadays, algorithmic trading is gaining traction among investors, especially during highly volatile markets. However, are you aware of the strategies to employ during such market conditions? If not, keep reading.

Top 5 Algo Trading Strategies to Explore Today

Here are the five best algo trading strategy to help make your trades successful when the market is volatile.

Mean Reversion

In volatile markets, mean reversion seeks to profit when asset prices deviate significantly from their average and are likely to return. As a trader, you first define a ‘mean’ using volatility thresholds or confirmation from momentum indicators to avoid false signals. When prices deviate significantly from this mean due to sudden market swings, your algorithm triggers trades expecting a reversal.

For example, suppose a stock is priced at around ₹500. Due to a sharp market dip, it drops to ₹450. Your algorithm identifies this as an oversold condition. You buy the stock, anticipating it will revert to ₹500. Once it does, the algo exits the trade.

Statistical Arbitrage

Statistical arbitrage strategy exploits temporary price discrepancies between related assets. For example, there are two stocks from the same sector, Company A and Company B. They both move in sync in normal market conditions. However, during market volatility, stock A unexpectedly drops, while stock B remains stable. Statistical arbitrage algorithms detect this deviation from their usual correlation.

The algorithm sells stock B, expecting it to drop, and buys stock A, anticipating a rebound. Once their prices converge to their usual relationship, the system closes the positions, profiting from the price difference.

Breakout Strategies

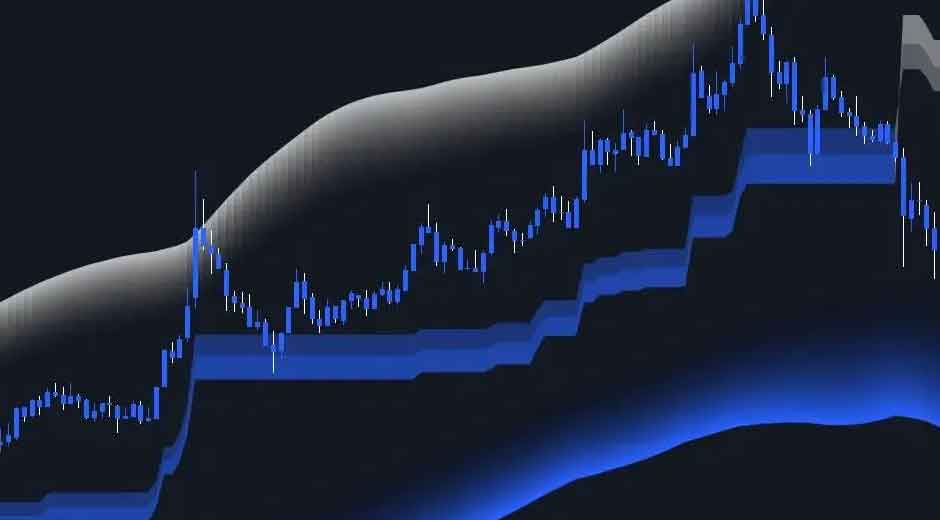

Breakout strategies help you capture strong price movements when an asset breaks through either its support or resistance level. In algo trading, when the price crosses a defined threshold with volume support, the bot enters a trade in the direction of the breakout.

For example, suppose a stock has been trading between ₹950 and ₹1000. Your algorithm monitors this range. If the price breaks above ₹1000 with increased volume, it signals bullish strength. The algorithm buys the stock, anticipating continued upward movement.

Volatility increases the chances of breakout opportunities, but it also raises the risk of false signals. To manage this, include filters such as waiting for a candle to close above the breakout level.

News-based Sentiment

News-based sentiment trading helps you overcome fluctuations by analysing news articles and social media to gauge market sentiment. This algorithm identifies keywords, phrases, and trends in real-time news feeds.

For example, during a market downturn, if news outlets report positive earnings for a major tech company, the algorithm detects an uptick in sentiment toward tech stocks.

This analysis guides your trading decisions by suggesting buying opportunities based on positive sentiment or warning against investments linked to negative news.

Regime Switching

Regime-switching adjusts its trading approach depending on the current market ‘regime’, such as high volatility or low volatility. This method uses Markov Switching Models to detect these regimes based on real-time data.

For example, suppose you are trading NIFTY. When the market is stable, the algorithm will apply a mean-reversion strategy, assuming that prices will return to average levels.

However, as soon as it detects high volatility, such as after a major economic event, the system will switch to a momentum-based approach with the expectation that the trend will continue.

Conclusion

When the stock market is highly volatile, it can lead to sharp and unpredictable movements in stock prices, which can go either way. During such times, if you do not employ the right strategy, the volatility can become risky.

If, as a trader, you prefer algorithmic trading and want to make your trades rewarding, consider fine-tuning your system to mean reversion, statistical arbitrage, breakout trades, news-based sentiment, or regime switching. These data-driven approaches can help you adapt and respond smartly, avoiding emotion-based decisions.